A Decade-Old Crypto Veteran, Zcash Is Facing a Midlife Crisis Too

Source: TechFlow (Shenchao)

On January 7, Zcash’s entire core development team resigned.

Not one or two people in a dispute—but the whole Electric Coin Company (ECC), around 25 people in total, including the CEO, walked out together.

ECC is the primary developer behind Zcash. Put simply, the people who write the code quit.

The market reacted immediately. ZEC fell more than 20% on the news.

A quick reminder: Zcash is almost ten years old.

It launched on October 28, 2016—earlier than many people even entered crypto. Its original selling point was “privacy transactions”: sender, receiver, and amount fully encrypted, invisible on-chain.

In reality, after nine years, less than 1% of ZEC transactions actually use the privacy feature

The remaining 99% are effectively transparent.

For nine years, usage stagnated while the team kept going. The price collapsed from over USD 3,000 at launch to around USD 15 in July 2024.

Then, at the end of 2025, ZEC suddenly took off.

From hovering around USD 40 earlier in the year, it surged to USD 744 on November 7, pushing market cap above USD 10 billion and back into the top 20.

The long-dormant “privacy coin” narrative suddenly became fashionable again.

And then—the development team left.

It reads like a midlife script: buy a Porsche, then get divorced. Get the year-end bonus, then break up.

When money is scarce, everyone is a comrade. When money arrives, the fight becomes about who decides.

So what was the fight about?

A wallet called Zashi.

Zashi is a mobile wallet launched by ECC in early 2024, designed with privacy enabled by default. It is the most important user gateway in the Zcash ecosystem.

ECC wanted to privatize Zashi, bring in external capital, and turn it into a venture-backed company that could raise funds and iterate quickly.

But ECC is not an independent for-profit company.

In 2020, ECC was placed under a nonprofit entity called Bootstrap, structured as a U.S. 501(c)(3).

In simple terms: this structure is designed for charities and public-interest organizations. The upside is tax exemption. The downside is that profits cannot be distributed internally, and asset decisions are subject to board approval.

At the time, this was done for compliance—to reduce regulatory pressure from the SEC. In the bear market, nobody cared. There was no money to fight over.

Now, the Bootstrap board said no.

Their reasoning was straightforward: as a nonprofit, they have a legal obligation to protect donor interests. Privatizing Zashi could be illegal, invite lawsuits, or trigger political backlash. They pointed to OpenAI as a cautionary example—how many lawsuits followed its attempt to move from nonprofit to for-profit.

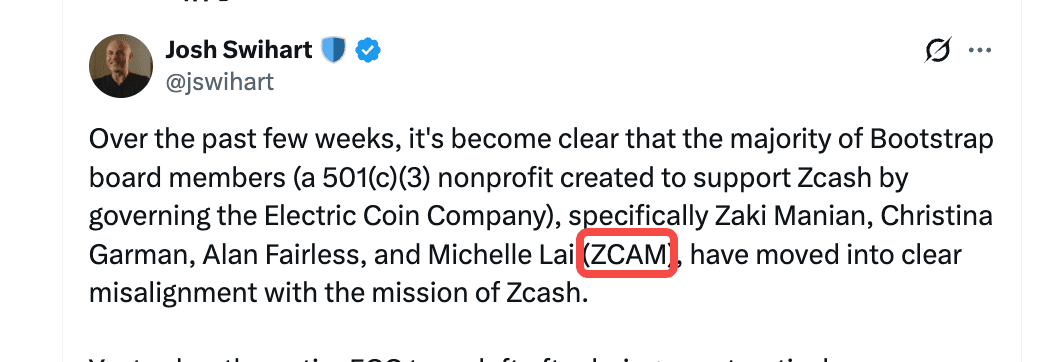

Former ECC CEO Josh Swihart strongly disagreed.

On X, he called the board’s actions “malicious governance behavior”, saying it made it “impossible for the team to perform its duties effectively and with dignity.”

He used a legal term: “constructive discharge”—meaning you’re not formally fired, but working conditions are made untenable, effectively forcing you to leave.

In this case, 25 people were forced out together.

Swihart also publicly named four board members: Zaki, Christina, Alan, and Michelle—and combined their initials into “ZCAM.”

ZCAM.

It sounds a lot like “SCAM.”

Whether intentional or not is unclear.

Among them, Zaki Manian has the most controversial history.

A long-time figure in the Cosmos ecosystem, he was a core member of Tendermint before resigning in 2020 after a public conflict with founder Jae Kwon.

In 2023, the FBI informed him that two developers in a project he oversaw were North Korean agents. He allegedly knew and did not disclose this for 16 months. In October 2024, Jae Kwon publicly accused him of gross negligenceand betraying community trust.

Today, he sits on the Zcash board.

One day after the mass resignation, the former ECC team announced a new company, code-named CashZ.

They said they would use the existing Zashi codebase to launch a new wallet within weeks. Existing Zashi users would be able to migrate seamlessly.

“We are still the same team, with the same mission: to build unstoppable private money.”

No new token. No fork. Just changing the shell and continuing the work.

The most ironic part of this story is the timing.

When ZEC was USD 15, nobody cared who controlled the wallet.

When it hit USD 500, the value of Zashi suddenly became existential.

Money clarifies relationships.

The same nonprofit-versus-startup tension played out very differently elsewhere. At OpenAI, the board lost. At Zcash, the team left.

Who “won” is unclear—but the conflict itself is common across crypto.

On the CashZ website, Swihart wrote why they left:

“The nonprofit foundation model is a relic of crypto’s compliance era. Back then, projects needed a ‘regulatory buffer’ to protect themselves. But those buffers bring bureaucracy and strategic deadlock. Startups can scale quickly. Nonprofits cannot.”

He added:

“Anyone who has spent time in crypto knows this: the entanglement between nonprofit foundations and tech startups is an endless source of drama.”

Endless drama indeed.

In 2023, when Zooko stepped down as CEO, rumors already circulated of disagreements with Swihart. In January 2025, Peter Van Valkenburgh, a board member of the Zcash Foundation, also resigned.

After ten years, most of the original figures are gone.

Someone asked on X: Will Zcash die?

The chain is still running.

The code still exists.

Only the people writing it have changed.

But Swihart is likely right: the tension between nonprofits and startups is a structural flaw in crypto governance. Cosmos fought over it. Ethereum fought over it. Solana fought over it too.

The difference is only in intensity and outcome.

Zcash chose the cleanest option of all.

Break up.

You may also like

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…