Bitcoin V-Shaped Reversal, CME Gap Could Be the Biggest "Risk"

Original Article Title: "After Bitcoin's V-Shaped Reversal, Could the CME Gap Be the Biggest 'Hidden Danger'?"

Original Source: BitpushNews

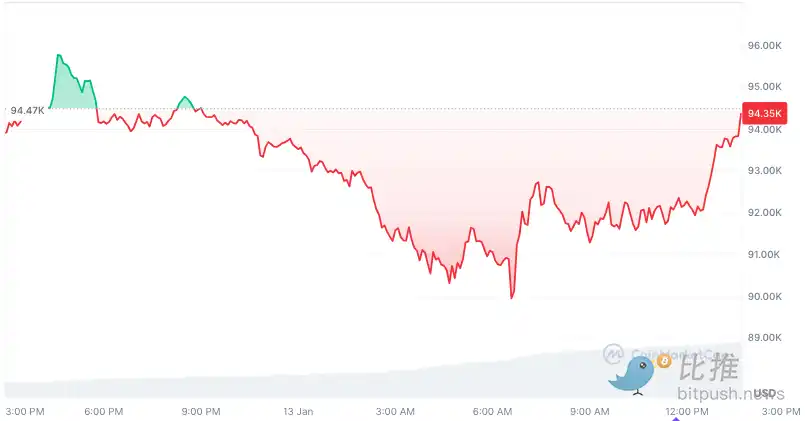

Over the past 24 hours, Bitcoin has staged a V-shaped reversal drama, hitting a low of $90,000, an eight-week low, and bouncing back above $94,000 after the U.S. stock market close, with the market's longs and shorts in a tense situation. Bitcoin's price has dropped over 7% in the past week. Although its market cap continues to hover around $1.864 trillion, its dominance has slightly decreased to 54.2%.

Macroeconomic Factors Lead to Temporary Market Cooling

Experts believe that the pullback that began last week is attributed to optimistic U.S. economic data, including better-than-expected initial jobless claims and labor participation rate. This data has heightened concerns that interest rates may remain high for a longer period than expected.

Chris Chung, CEO and Founder of Titan, stated: "The market seems very concerned that there won't be any more rate cuts in 2025, especially given the incredibly strong jobs report released on Friday. But we also saw a big rally in December, so it's not uncommon for the market to readjust after such a large rally."

He pointed out that with U.S. President-elect Donald Trump set to be inaugurated next week, there is still "further downside risk" in the cryptocurrency market.

Chris Chung said: "Everyone expects Trump to announce regulatory support for cryptocurrency on day one, but he may start with more pressing issues given the Republican control of the House and Senate, along with macro concerns and upcoming token unlocks, this market adjustment may continue into February or even March."

James Butterfill, Head of Research at CoinShares, stated in his fund report: "The honeymoon period after the U.S. election is over, and macroeconomic data once again becomes a key driver of asset prices."

Derivatives Data Shows Sentiment Ranges from Mildly Bullish to Neutral

It is worth noting that the reaction in the Bitcoin derivatives market has been relatively mild.

Firstly, the futures premium is high, as Bitcoin futures contracts typically trade at a premium to the spot market, reflecting market optimism about future prices. Data shows that the current annualized premium rate is at 11%, above the 5%-10% neutral range, indicating that market participants overall remain optimistic.

Another indicator is the perpetual contract funding rate (usually reflecting market sentiment). Although on January 13, due to a large number of short positions entering the market, the funding rate briefly turned negative, accompanied by $1.07 billion in long liquidations. However, it quickly rebounded to around 0.5% monthly rate, showing that the market did not exhibit sustained bearish sentiment.

CME Gap Pressure, Will It Be Filled?

Analysts say there is a gap between $88,500 and $77,500 on the CME chart. When there is a difference in the Bitcoin futures price between the close of one trading day and the open of the next trading day, a CME gap occurs, which usually causes Bitcoin to tend to return to a certain level. If Bitcoin faces a downward correction, this gap represents a potential bearish target.

Analysts believe that given Bitcoin's current price of around $94,000, a drop from this level could lead to a significant pullback, potentially resulting in a decline of up to 18% to fill this CME gap.

In addition to the CME gap, veteran market analysts like Peter Brandt also point out a potential bearish signal on the Bitcoin daily chart. Brandt suggests that a head and shoulders pattern could form, which may indicate that the Bitcoin price could fall to $73,000. However, Brandt also warns against relying too heavily on this chart as BTC's high volatility often leads to changes in chart patterns.

Therefore, Bitcoin's current trend is influenced by multiple complex factors. While the derivatives market remains relatively calm, the presence of the CME futures market gap, a potential head and shoulders pattern, and key support levels increase the risk of a price downturn. If Bitcoin continues to face pressure, the market will closely monitor whether it will fill the CME gap, which could trigger significant market volatility.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…