Global Stablecoin Regulation Update Overview

Original Article Title: "WOO X Research: Stablecoins: An Overview of New Regulatory Dynamics"

Original Source: WOO

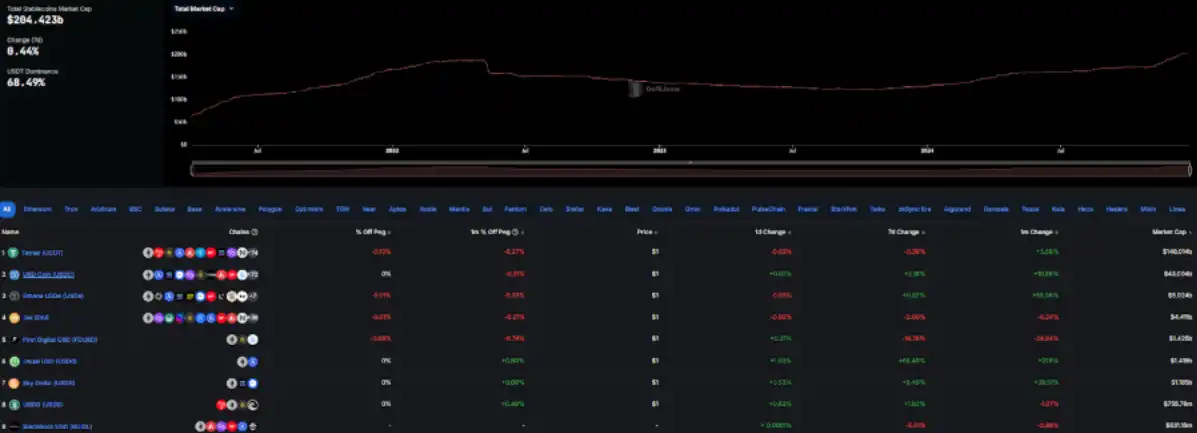

In recent years, the rapid development of stablecoins has attracted the attention of regulatory agencies worldwide. As a type of cryptocurrency pegged to fiat currency or other assets, stablecoins possess the characteristic of price stability and have been widely used in areas such as cross-border payments and DeFi. Particularly in this cycle, Real World Assets (RWAs) have performed well, with both traditional financial institutions (such as BlackRock) and web3-native institutions/organizations (such as Sky, formerly MakerDAO) entering the space. More and more investors are also paying attention to this sector, leading to a trend of ranging growth.

(Image Source: https://defillama.com/stablecoins)

"Regulations are necessary for orderly development," and consequently, governments and international organizations have begun to introduce policies to regulate stablecoins. This article provides a brief summary of the current regulatory landscape.

United States (North America)

The United States is one of the primary markets for stablecoin development, and its regulatory policies are relatively complex. The U.S. stablecoin regulatory framework is mainly implemented by multiple agencies, including the Treasury Department, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC).

For certain stablecoins, the SEC may deem them to have securities attributes, requiring compliance with the relevant securities laws. The Office of the Comptroller of the Currency (OCC) under the Treasury Department has proposed allowing national banks and federal savings associations to provide services to stablecoin issuers, subject to anti-money laundering and compliance requirements. Recently, the U.S. Congress has been discussing legislative proposals such as the "Stablecoin Transparency Act" in an attempt to establish a unified regulatory framework for stablecoins. With the election of Donald Trump, often referred to as the "Crypto President," although the policies have not yet been implemented, cryptocurrency regulation seems to be generally trending positively.

European Union (Europe)

Stablecoin regulation in the European Union primarily relies on the Markets in Crypto-Assets Regulation (MiCA).

MiCA categorizes stablecoins into Asset-Referenced Tokens (ARTs) and Electronic Money Tokens (EMTs). Electronic Money Tokens (EMTs) refer to tokens pegged to a single fiat currency, such as stablecoins pegged to the Euro or the Dollar. Meanwhile, Asset-Referenced Tokens (ARTs) refer to tokens pegged to certain assets (such as fiat currency, commodities, or cryptocurrencies). MiCA sets out corresponding regulatory requirements for each category. Entities issuing stablecoins must obtain a license from an EU member state and meet requirements such as capital reserve and transparency disclosure.

Hong Kong (Asia)

On July 17, 2024, the Hong Kong Monetary Authority and the Financial Services and the Treasury Bureau jointly issued a consultation summary outlining the key features of the upcoming stablecoin regulatory regime. Under this regime, companies looking to issue or promote fiat-backed stablecoins to the Hong Kong public will need to obtain a license from the HKMA. The regulatory requirements include asset reserves management, corporate governance, risk controls, disclosure, and measures to combat money laundering and terrorist financing.

(Image Source Link: https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/07/20240717-3/?utm_source=chatgpt.com)

In addition, the HKMA has introduced a stablecoin issuer sandbox scheme to engage with the industry on the proposed regulatory requirements. The first list of participants was announced on July 18, 2024, including JD Coinchain Technology (Hong Kong) Limited, Roundcoin Innovation Technology Limited, and a consortium composed of Standard Chartered Bank (Hong Kong) Limited, Animoca Brands Limited, and Hong Kong Telecom Limited.

(Image Source Link: https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/stablecoin-issuers/?utm_source=chatgpt.com)

Recently, on December 6, 2024, the government published the "Stablecoin Bill" in the Gazette, aiming to introduce a regulatory regime for fiat-backed stablecoin issuers in Hong Kong to enhance the oversight framework for virtual asset activities.

Singapore (Asia)

Under Singapore's Payment Services Act, stablecoins are considered digital payment tokens, and their issuance and circulation require approval from the Monetary Authority of Singapore (MAS). MAS provides a regulatory sandbox for startups to test business models related to stablecoins.

Japan (Asia)

In June 2022, Japan revised the Payment Services Act (PSA), establishing a regulatory framework for the issuance and trading of stablecoins. Under the amended PSA, stablecoins fully backed by fiat currency are defined as "Electronic Payment Instruments" (EPI) that can be used to pay for goods and services. There are specific requirements for the issuing entities: only three types of institutions can issue stablecoins: banks, funds transfer service providers, and trust companies. Institutions wishing to engage in stablecoin-related activities must first register as Electronic Payment Instrument Service Providers (EPISP) to obtain the necessary licenses to provide services.

Brazil (South America)

In October 2024, BCB President Roberto Campos Neto announced plans to regulate stablecoins and asset tokenization in 2025. In November 2024, BCB proposed a regulatory measure suggesting a ban on users withdrawing stablecoins from centralized exchanges to self-custody wallets. Additionally, in December, BCB's Deputy Director of the Financial System stated that the central bank might lift the ban if key issues such as transaction transparency are addressed.

Conclusion

Furthermore, Russia, a BRICS country, is also considering using cryptocurrency as a settlement method for cross-border financing. Overall, whether it's creating regulatory sandboxes for crypto companies or defining categories based on stablecoins' different characteristics, more and more stablecoin regulatory policies will be introduced in the future. Cross-border payments seem to be one of the most widely applicable scenarios for stablecoins.

This article is a contributed piece and does not represent the views of BlockBeats.

You may also like

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…