The Fed Keeps Interest Rates Unchanged, Sending Markets into a "Two-Speed" World

Original Title: "After the Fed Hits the Brakes, the Market Experiences a Drastic Change"

Original Author: seed.eth, Bitpush News

After three consecutive rate cuts, the Fed finally pressed the "pause button" at its first monetary policy meeting of 2026.

In the early hours of Thursday Beijing time, the Fed announced that it would maintain the target range for the federal funds rate at 3.5% to 3.75%. This somewhat "flat" decision was in line with expectations of over 97% of the market. However, it also revealed subtle divisions within the policy: two Fed officials dissented and voted to continue cutting rates by 25 basis points.

The Shoe Drops, but the Direction Remains Uncertain

In its policy statement, the Fed continued its relatively cautious language: the economy is still in a "solid expansion," inflation "has moderated but is still above target," there are signs of cooling in the labor market, but it has not yet posed a systemic risk. The core message is clear—the monetary policy has transitioned from an "active adjustment" phase to an "observation validation" phase.

It is worth noting that there is not complete consensus within the Federal Open Market Committee. Two members voted to continue cutting rates, indicating a divergence in policy direction between moderating inflation and economic slowdown. However, overall, the Fed clearly showed its reluctance to make new policy commitments in the current environment and chose to defer the decision-making to future data.

This stance has set the tone for the market: there will be no clear directional guidance in the short term, and asset pricing will revolve more around "expected changes" rather than "policy changes."

Current federal funds rate market pricing shows that investors generally expect rates to remain unchanged this quarter, with the first rate cut now pointing to June of this year, and the market further anticipates a possible pause in the rate-cutting cycle until 2027.

However, there are still significant differences among institutions regarding the interest rate path after this quarter: Morgan Stanley, Citigroup, and Goldman Sachs predict rate cuts in June and September, Barclays believes there may be cuts in June and December, while JPMorgan maintains its expectation of no rate changes throughout the year.

Macro Markets: Gold Shines Alone, While Other Assets Remain Calm

If the Fed's decision itself did not cause much turbulence, then the divergence in asset performance is the signal that deserves real attention.

After the rate decision was announced, the spot gold price surged all the way, breaking through the $5500 per ounce mark for the first time. In just four trading days, the gold price rose from slightly below $5000 all the way up, breaking through multiple hundred-dollar levels, with a total increase of over $500 and a weekly gain of 10%. This speed and magnitude have made gold the undisputed star of the current global market.

The strengthening of gold is not simply driven by interest rate trading logic. Despite the Federal Reserve pausing its rate cuts, after a period of continuous easing, monetary policy is now approaching a neutral range, easing the marginal constraint of real interest rates. Meanwhile, a mix of inflation resilience, trade frictions, political uncertainty, and global policy games have continued to amplify risk aversion. Amidst multiple layers of uncertainty, funds have chosen the most traditional and widely accepted safe-haven asset.

In stark contrast to gold, other assets have shown a lackluster performance. U.S. stocks have maintained narrow fluctuations post-decision, without showing any trending breakthroughs; the U.S. dollar index has seen limited volatility; U.S. bond yields have made slight adjustments but have not evolved into a systemic risk-off trend.

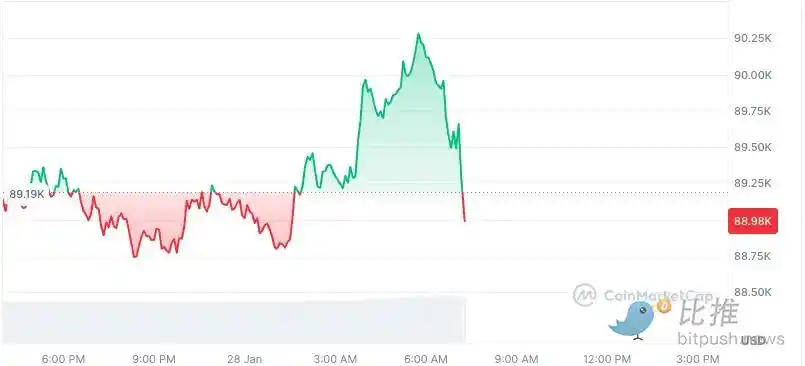

The same is true for crypto assets. Following the news announcement, the price of Bitcoin briefly dipped from $89,600 to the $89,000 level, then quickly rebounded to around $89,300. The price fluctuation was less than 1%. Ethereum (ETH) lingered around the $3,000 mark, while mainstream altcoins like Solana and XRP also remained within their previous ranges of consolidation.

The market has given the answer in the most straightforward manner: when the direction is unclear, gold is pushed back to the center stage, while other assets enter a wait-and-see mode.

A More Important Question than Rate Cuts: Who Will Shape the Next Phase of the Federal Reserve?

After the rate decision has been made, the market's focus quickly shifted. Rather than "when will the rates be cut," investors began to concentrate on another question: who will lead the next phase of the Federal Reserve?

According to the latest data from Polymarket, in the "Who will Trump nominate for Fed chair" betting market, several candidates have pulled ahead in terms of odds:

Rick Rieder: The Market's Favorite "Pragmatist" (about 34%)

Currently, the highest betting probability is for Rick Rieder, with a support rate of about 34%, showing a recent significant increase.

Rieder currently serves as the Global Chief Investment Officer for Fixed Income at BlackRock, with a long history of deep involvement in the bond market and macro asset allocation decisions, seen as one of the very few individuals truly spanning "policy-market-funding structure." His public views often emphasize financial market stability, policy transmission efficiency, and the avoidance of unnecessary systemic shocks.

In the market's view, if Rieder were to become the Fed chair, it would mean that central bank decisions would pay more attention to financial conditions and asset price signals, maintaining policy flexibility within the bounds of inflation. This expectation explains why he is gaining more and more financial support in the prediction market—a bet on "predictability" and "market-friendliness."

Kevin Warsh: Advocate of Discipline and Credibility (Approx. 28%)

In second place is former Fed Governor Kevin Warsh, currently with betting odds of around 28%.

Warsh has been known for his clear stance and tough approach, emphasizing central bank credibility and long-term discipline regarding inflation. He has repeatedly expressed concerns about overly accommodative policies and is seen as a key representative of the traditional hawkish view.

If Warsh ultimately wins, the market generally expects the Fed to be more cautious in its rate-cutting pace, asset price tolerance, and policy communication. This style is usually favorable for curbing inflation expectations but also implies that risk assets will need to adapt to a stricter financial environment.

Christopher Waller: Academic Fed Governor (Approx. 20%)

Current Fed Governor Christopher Waller has betting odds of approximately 20%, placing him third.

Waller has a strong academic background, clear policy logic, and has long been seen as the most influential "hawk" within the Fed (advocating higher interest rates to curb inflation). However, in this FOMC meeting, he cast a dissenting vote in support of continuing rate cuts, indicating that he believes inflation is no longer a primary threat or that he is under significant political/economic pressure.

If Waller takes over, the Fed may give more weight to employment and growth targets, with a relatively flexible policy pace. However, whether he can maintain central bank independence in a highly politicized environment remains a focal point of market attention.

Will Bitcoin Continue Its Bearish Trend?

Amid increasing macro uncertainty, on-chain data is beginning to reveal concerning signals.

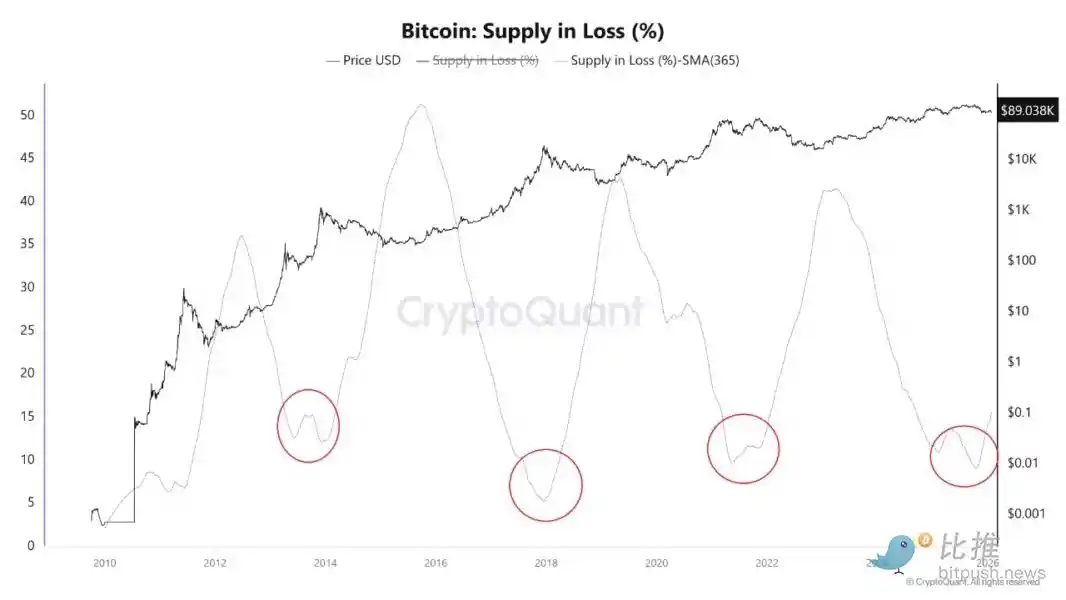

CryptoQuant's latest analysis shows that the Bitcoin "Supply in Loss" (Supply in Loss) 365-day moving average is trending upwards. This indicator is used to measure the percentage of Bitcoin currently priced below its last on-chain movement, serving as a crucial tool to observe market structure changes.

When Bitcoin hit its all-time high of $126,000 in October last year, this indicator plummeted to the lowest of the cycle, reflecting a highly profitable market state. However, as the price retreated, Supply in Loss began to rise steadily, indicating that losses are gradually spreading from short-term traders to longer-term holders.

From a historical perspective, such a directional shift often occurs in the early stages of a bull-bear transition. However, it is important to emphasize that the indicator has not yet entered the typical "surrender range," appearing more like a risk signal rather than a trend confirmation.

This means that the current state of Bitcoin is more akin to high-level digestion and structural reorganization rather than having already entered a clear bear market decline phase. Whether it will evolve into a deeper correction still heavily depends on macro liquidity and subsequent fund flows. Gabe Selby, Head of Research at CF Benchmarks, stated: "Bitcoin's short-term bullish catalysts still exist but are increasingly leaning towards political factors rather than monetary factors."

Summary: Macro uncertainty, structural changes, the market awaits answers

Overall, this round of market change is not primarily driven by a single event but rather the result of multiple factors working together; funds embrace gold in uncertainty, pushing risk-off sentiment to the forefront. Bitcoin's next steps still await further convergence of macro and cyclical signals.

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

Bitcoin’s 7% Drop to $77K Might Indicate Cycle Low, Analyst Suggests

Key Takeaways: Bitcoin has experienced a significant drop from $77,000 to around $78,600 after a modest rebound. Analyst…

Tom Lee–Linked Bitmine Faces Over $6B in Unrealized Losses on ETH Reserve

Key Takeaways: Bitmine Immersion Technologies reports significant unrealized losses exceeding $6 billion from its Ether reserves. The firm…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…