What is the secret behind XRP's surging price?

Original Article Title: Behind the XRP Breakout: Drivers and Dynamics

Original Article Author: KoreanDegen, Crypto Kol

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The recent surge in XRP price has caught everyone's attention, resulting from a combination of multiple factors such as a technical breakout, renewed interest from Korean investors (along with the dismissal of the SEC lawsuit and the WisdomTree S-1 filing), and the absence of historical sell pressures from figures like Jed McCaleb. These factors together drove demand for XRP, leading to exceptional market performance.

Below is the original content (slightly reorganized for better readability):

The recent breakout of XRP has unveiled a complex interaction between technicals, market structure, and regional dynamics.

Market Background

On November 10, XRP surged above around $0.55, decisively breaking through the 100-week, 200-week, and 350-week moving averages.

Perpetual Contract CVD: Decreasing.

Open Interest Volume: Increasing.

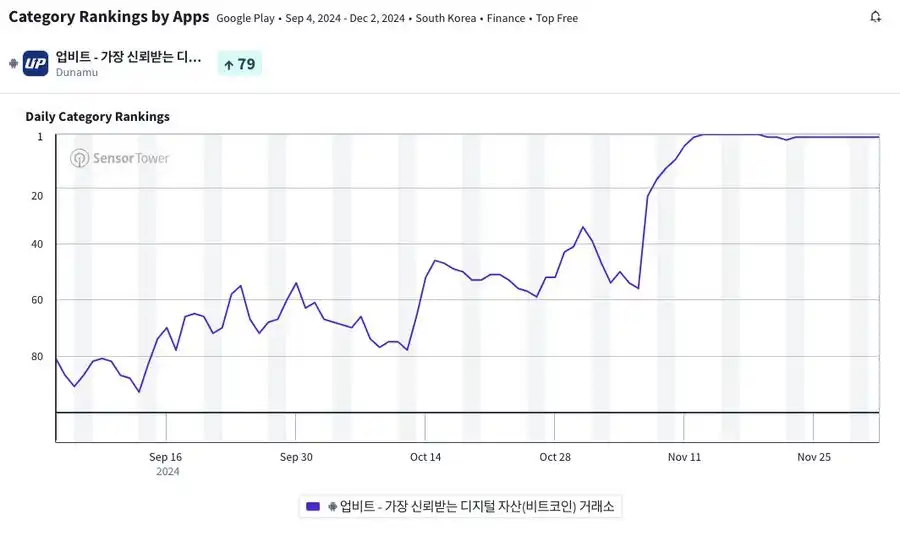

Simultaneously, Upbit's rankings on the App Store and Play Store started rising. The intersection of these factors hinted at brewing market activity.

November 12: Inflection Point

Upbit claimed the top spot in the Play Store rankings, considering Korea's user demographic — primarily older investors aged 50 to 60, predominantly on Android devices with Samsung holding a dominant position — this signal was particularly significant.

With the surge in demand, XRP crossed the ₩1,000 Korean Won mark (around $0.71). Arbitrageurs swiftly adjusted the market imbalance, leading to a significant number of short positions being liquidated.

Supply Void

In previous cycles, Jed McCaleb's continuous selling constrained XRP's upward momentum. However, this time he no longer has more coins to sell.

Structural Breakthrough

Only the historical charts of Bitstamp and Upbit can be traced back to 2017, showing a six-year continuous diagonal breakthrough. Meanwhile, Upbit's overwhelming advantage in spot trading volume has become a symbol of South Korea's investment enthusiasm.

Characteristics of the Demand Group

According to a recent report by the "Hankyung News," the role of older South Korean investors in the crypto market is becoming increasingly prominent:

Since 2021, the number of crypto accounts held by individuals aged 60 and above has increased by 30% (+188,000 new accounts).

The group of individuals aged 50 and above has seen a 22.5% increase in accounts (+356,000 accounts).

By September 2024, individuals aged 60 and above collectively hold $4.8 billion in crypto assets.

This demographic shift indicates that older investors, particularly in South Korea, have played a key role in driving XRP demand.

Article Link: Hankyung Article

Broader Context

While South Korea's trading volume is a major factor, it is not the sole driving force. Other exchanges, such as Coinbase and Robinhood, have also contributed to XRP's surge. Currently, XRP's spot trading volume has exceeded $6.6 billion.

This is not just a regular uptrend. It is a convergence of the following factors:

1. Key Technological Breakthrough.

2. Retail Investors, especially Korean investors, regained interest (subsequently further fueled by SEC lawsuit dismissal and WisdomTree S-1 filing).

3. Major historical sell pressure sources like Jed McCaleb's supply absence.

When causality and multiple factors collide, the result is often extraordinary.

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…